This is a collection of work I've done for a UI/UX project on financial challenges.

Problem Space

Young adulthood spanning ages 18–25 is a period for establishing financial well-being. However, many individuals in this demographic face significant challenges when it comes to managing their personal finances effectively:

- Lack of financial literacy: Many young adults have a limited understanding of budgeting, saving, investing, and debt management, leading to poor financial decision-making

- Difficulty tracking expenses/investments: Monitoring multiple accounts and platforms can be cumbersome, making it hard to maintain an accurate financial picture and understand portfolio performance without specialized experience.

- Motivation and accountability issues: Young adults often lack the drive to prioritize long-term financial goals over short-term desires and may not have access to support systems that encourage responsible money habits.

- Competing financial priorities: Student loan debt, housing costs, and discretionary spending can strain limited resources and make it hard to allocate funds effectively.

- Emotional barriers: Stress, anxiety, shame, or avoidance of financial topics often prevents proactive engagement with finances, making it difficult for young adults to navigate through the financial space.

Target Audience

The target audience of young adults aged 18–25 encompasses a diverse range of subgroups with distinct financial needs and challenges. These include college students managing educational expenses and debt, early career professionals navigating the transition to financial independence, freelancers with unique cash flow and tax considerations, low-income young adults facing systemic barriers to financial inclusion, high-income young professionals seeking advanced wealth-building strategies, and young parents balancing the responsibilities of providing for their families.

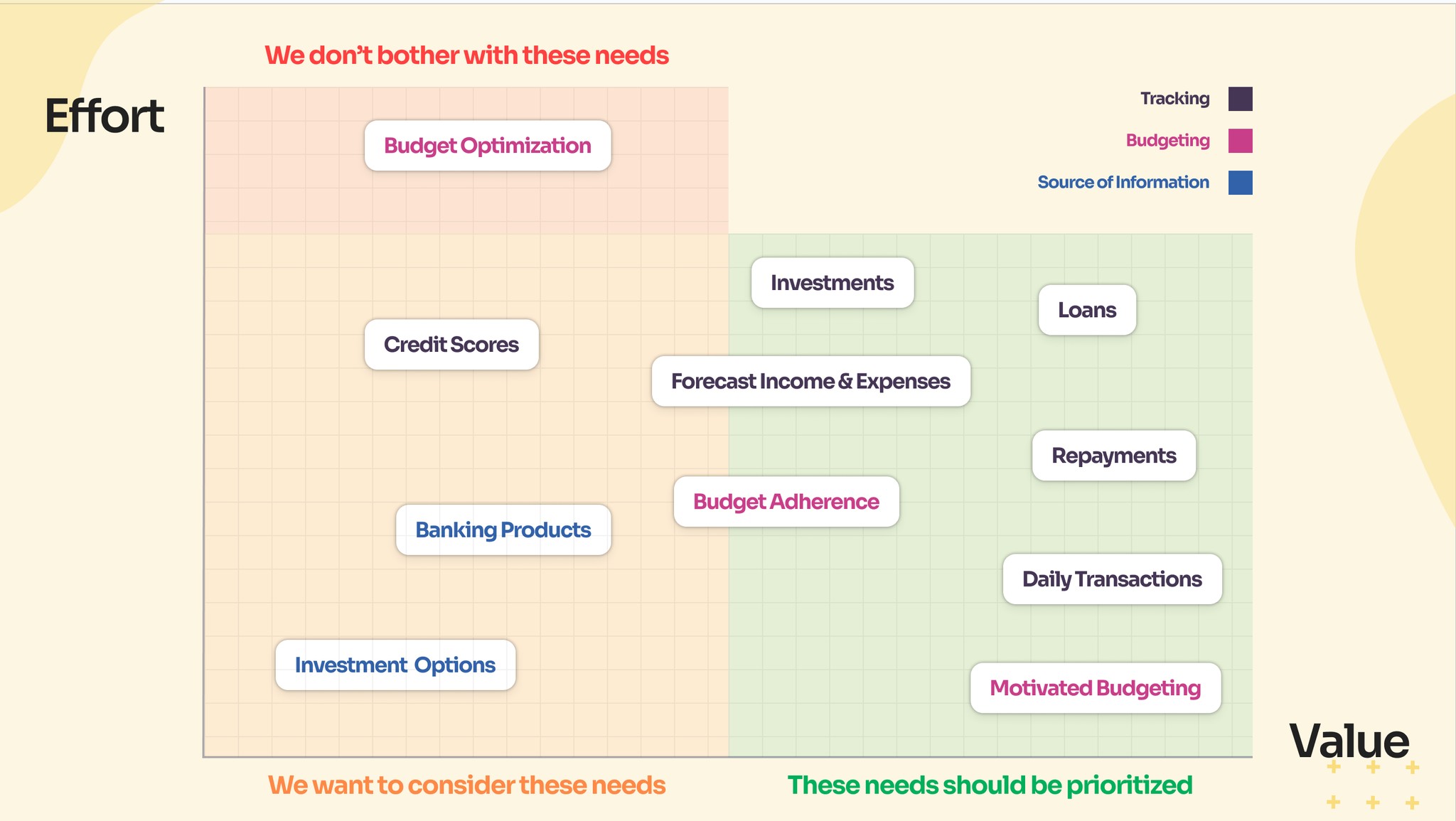

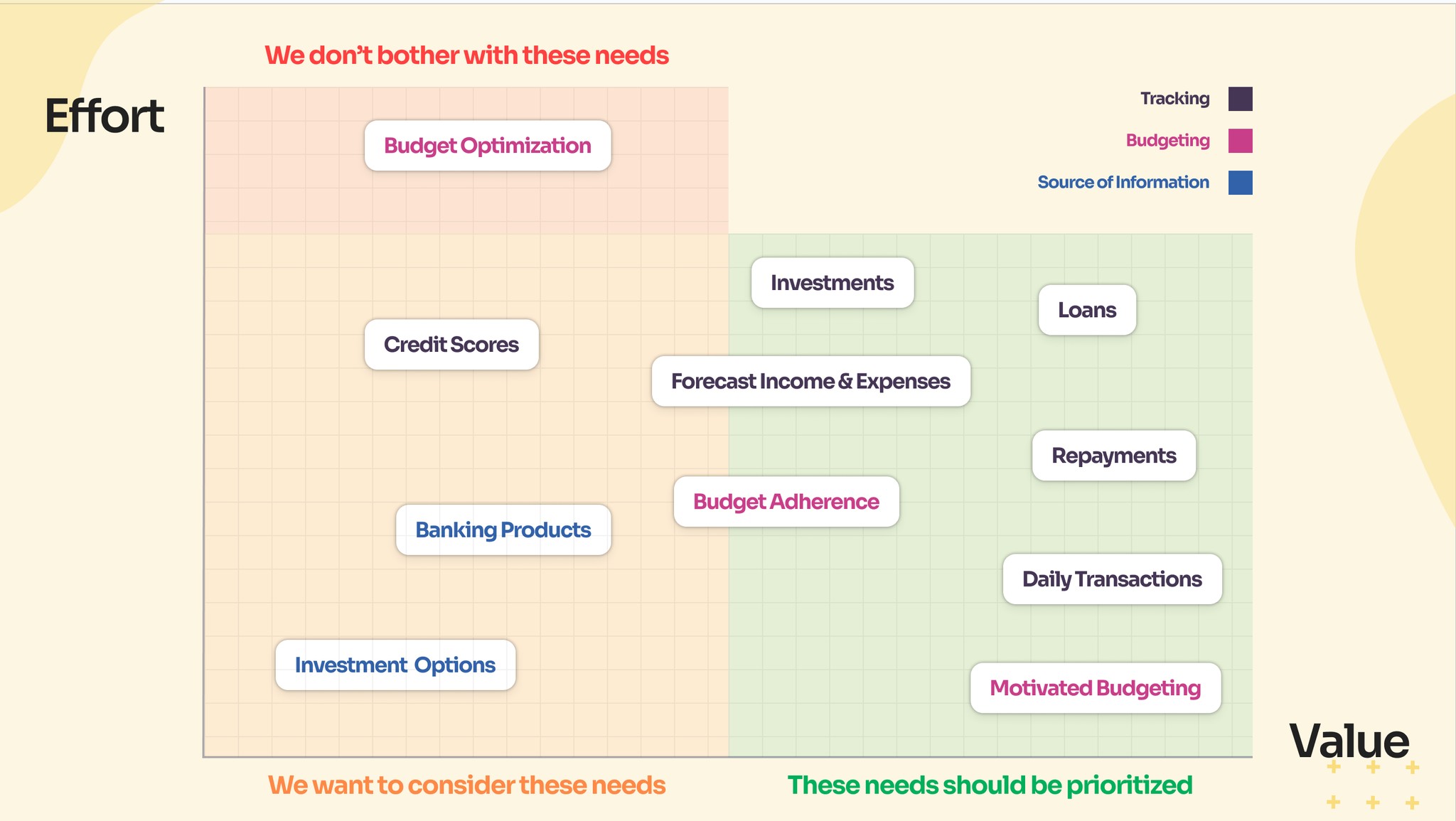

Goals

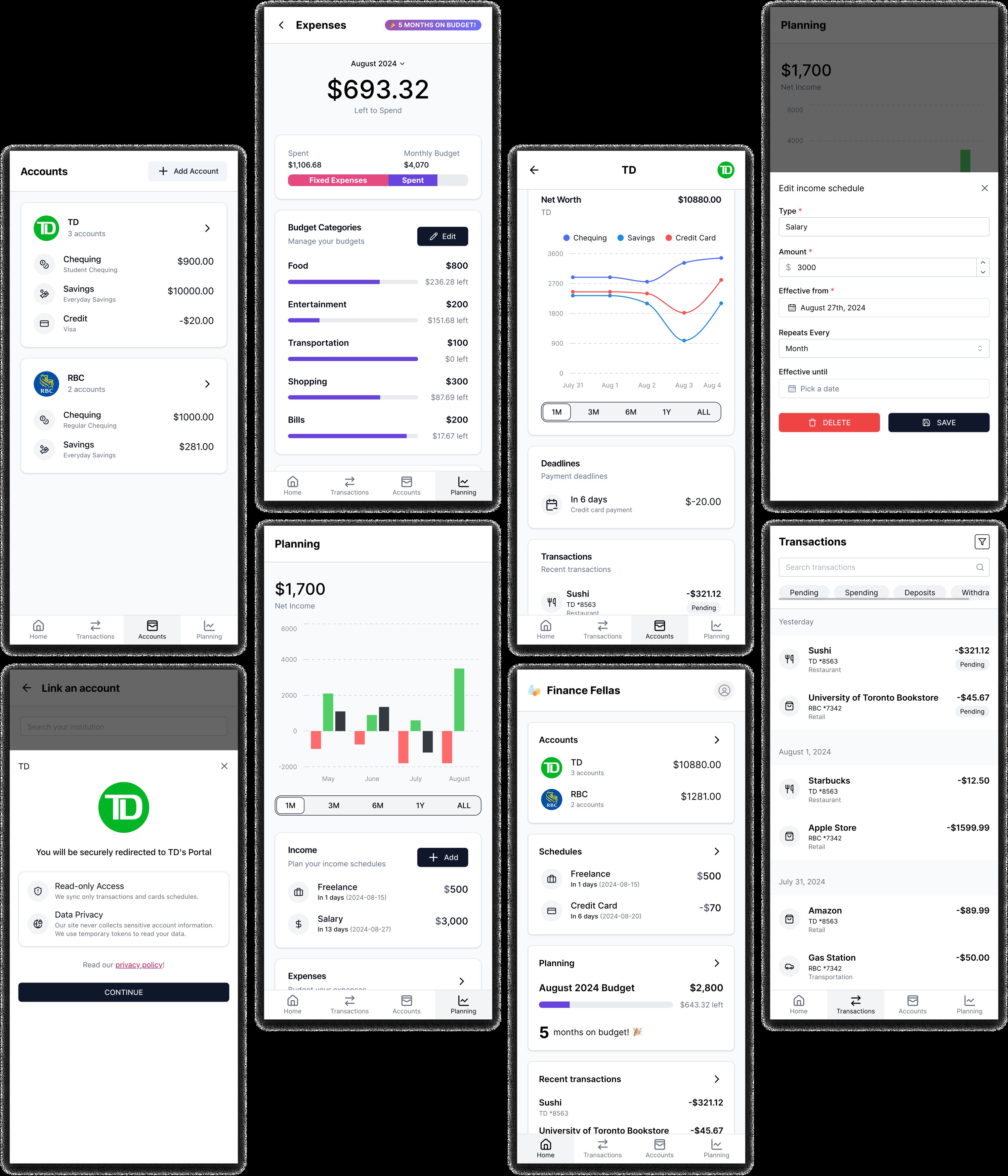

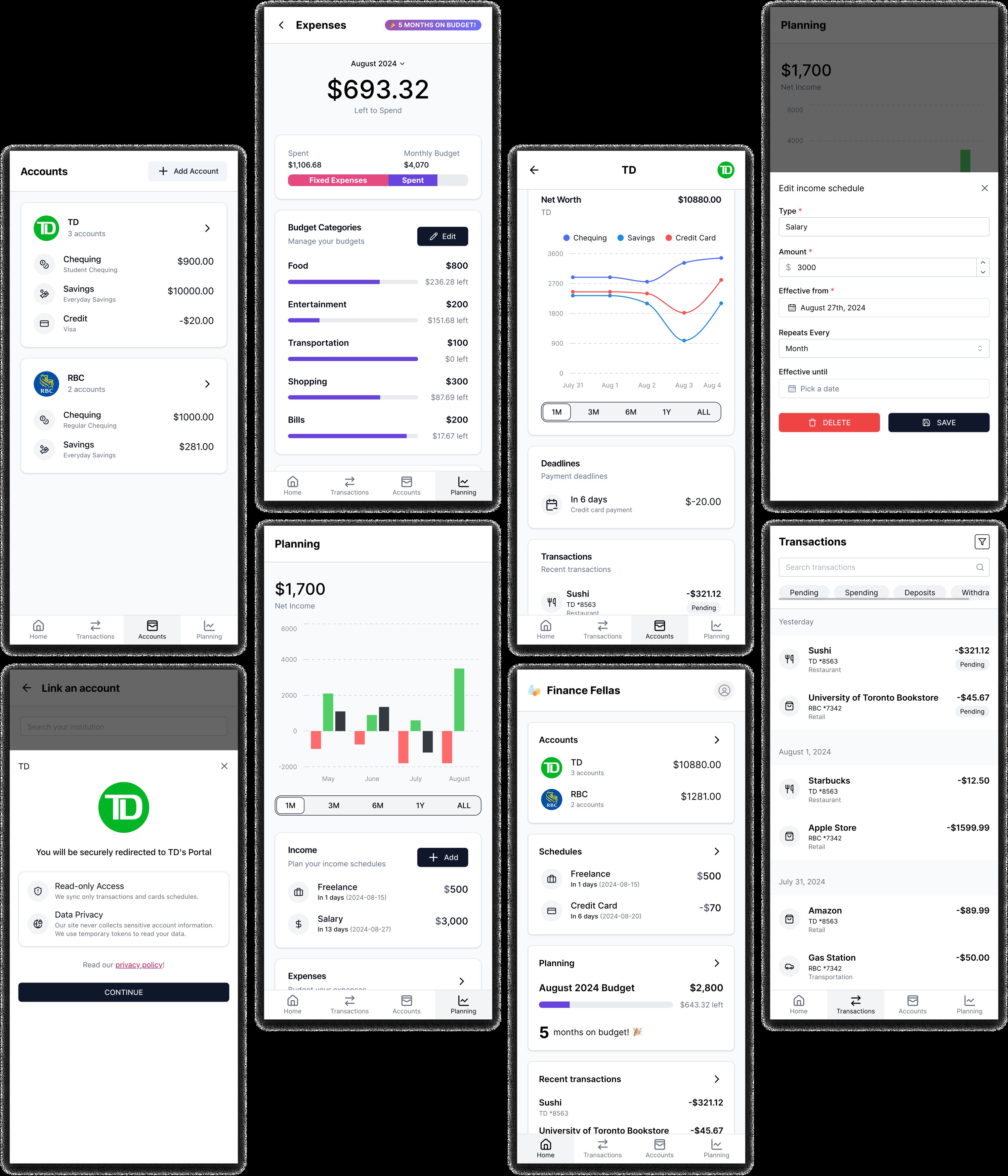

This project aims to understand the financial challenges, needs, and preferences of young adults, focusing on investing, spending, and saving behaviors. Through user and background research, we will seek to uncover the real issues this audience faces in personal finance. By identifying gamifiable opportunities for engaging, educational, and empowering experiences, we hope to support the development of knowledge, skills, and habits necessary for long-term financial well-being.

Project Files

You can play around with the interactive prototype here.

Tags:

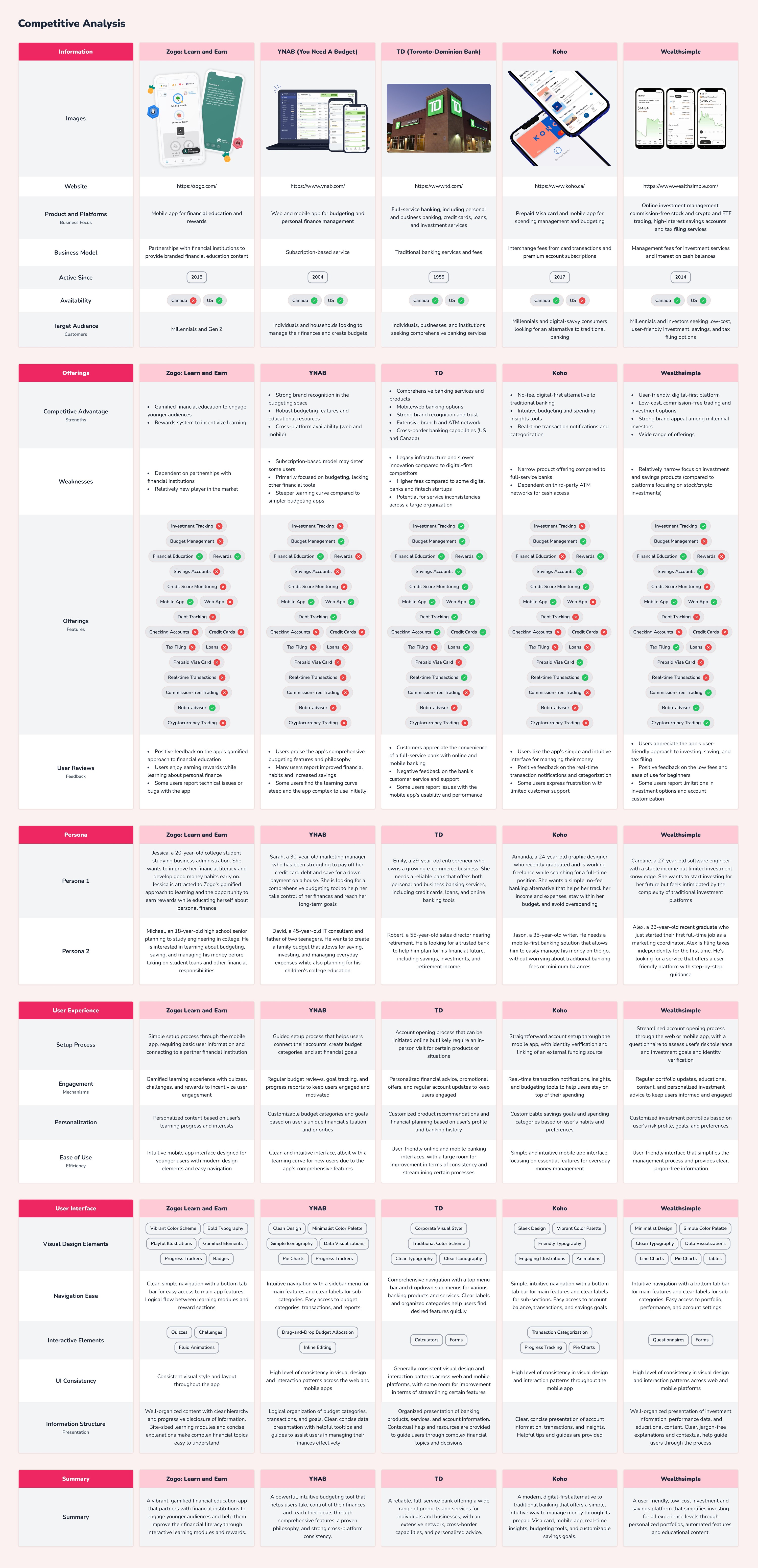

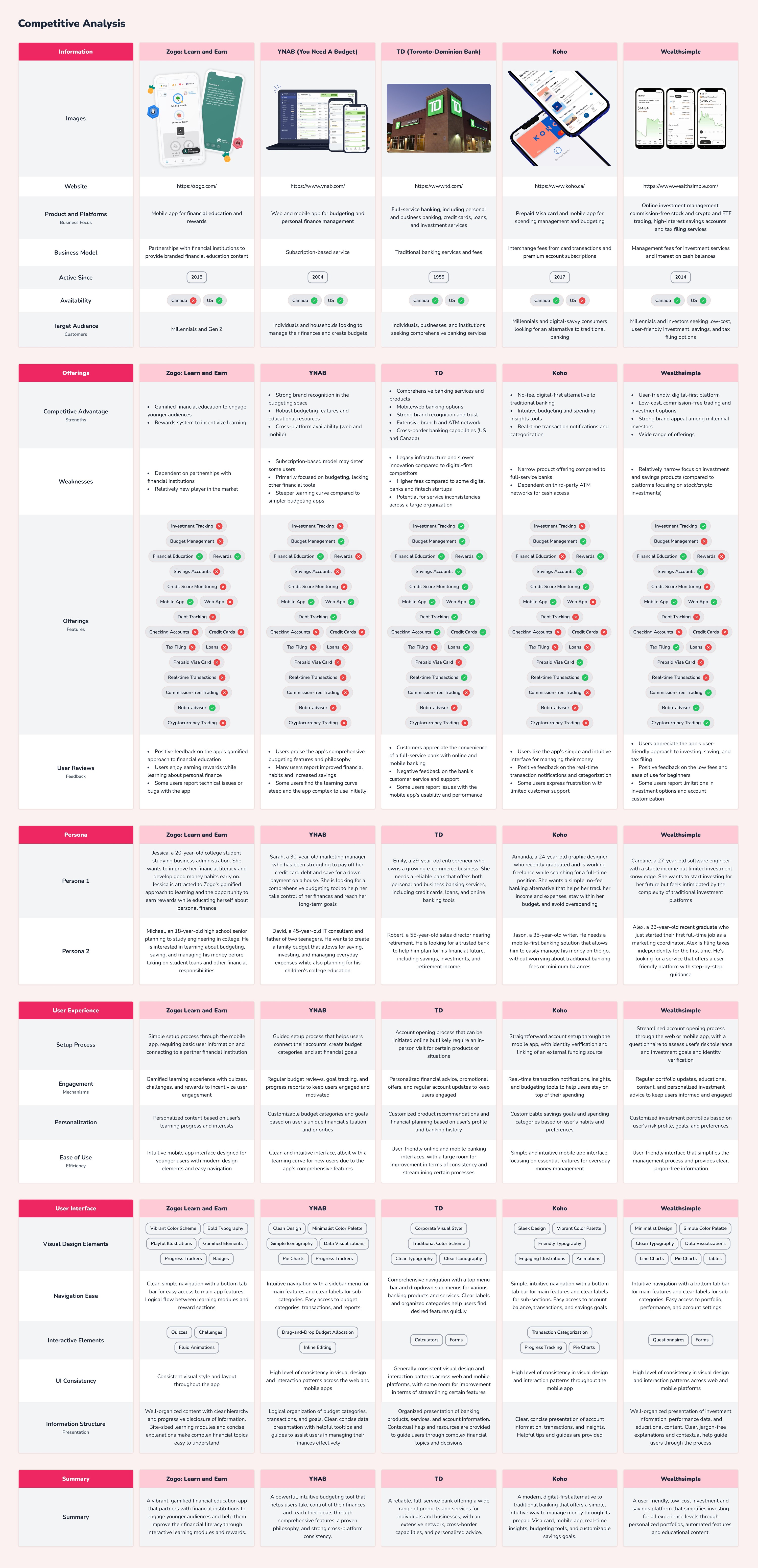

Competitive Analysis,

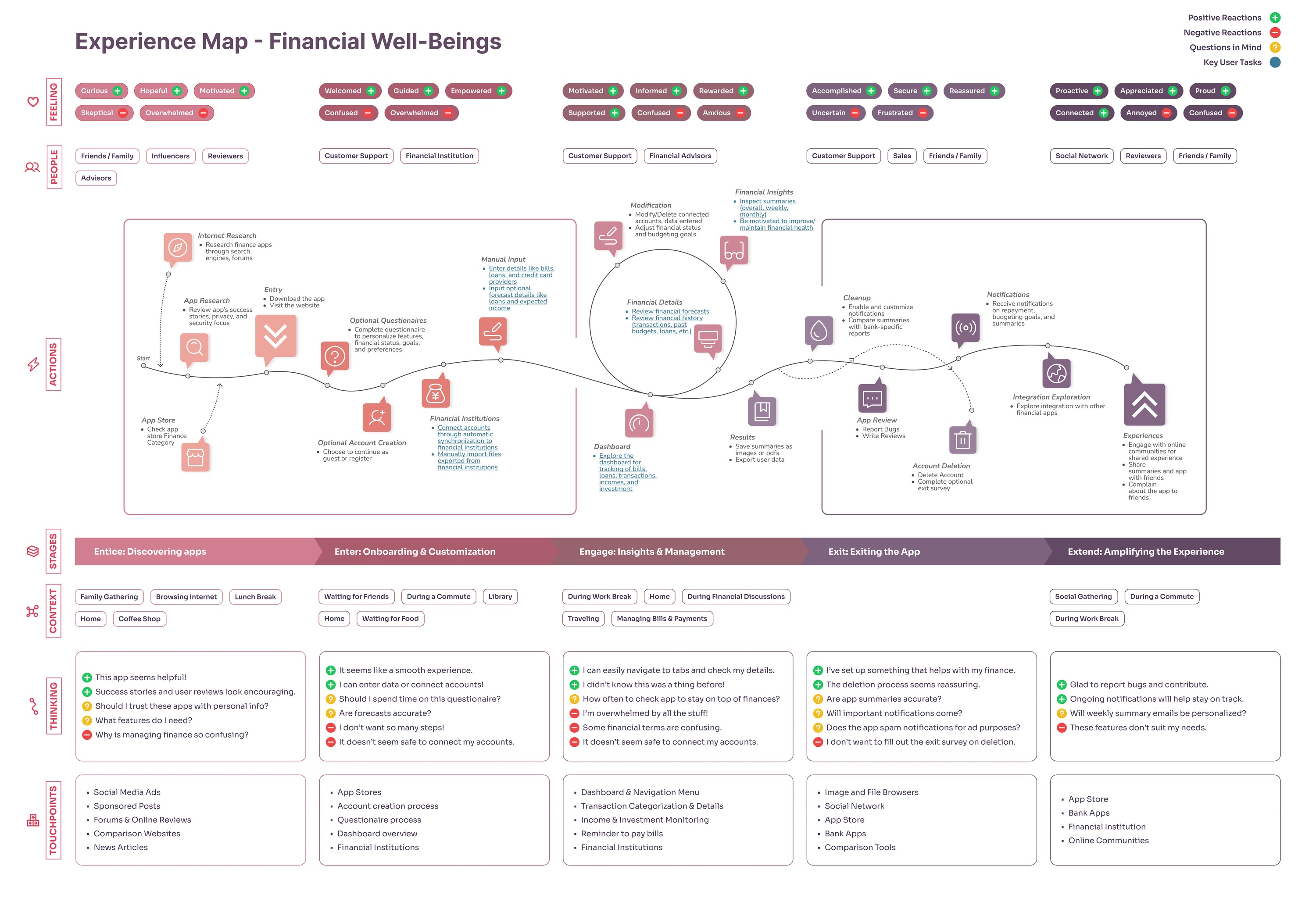

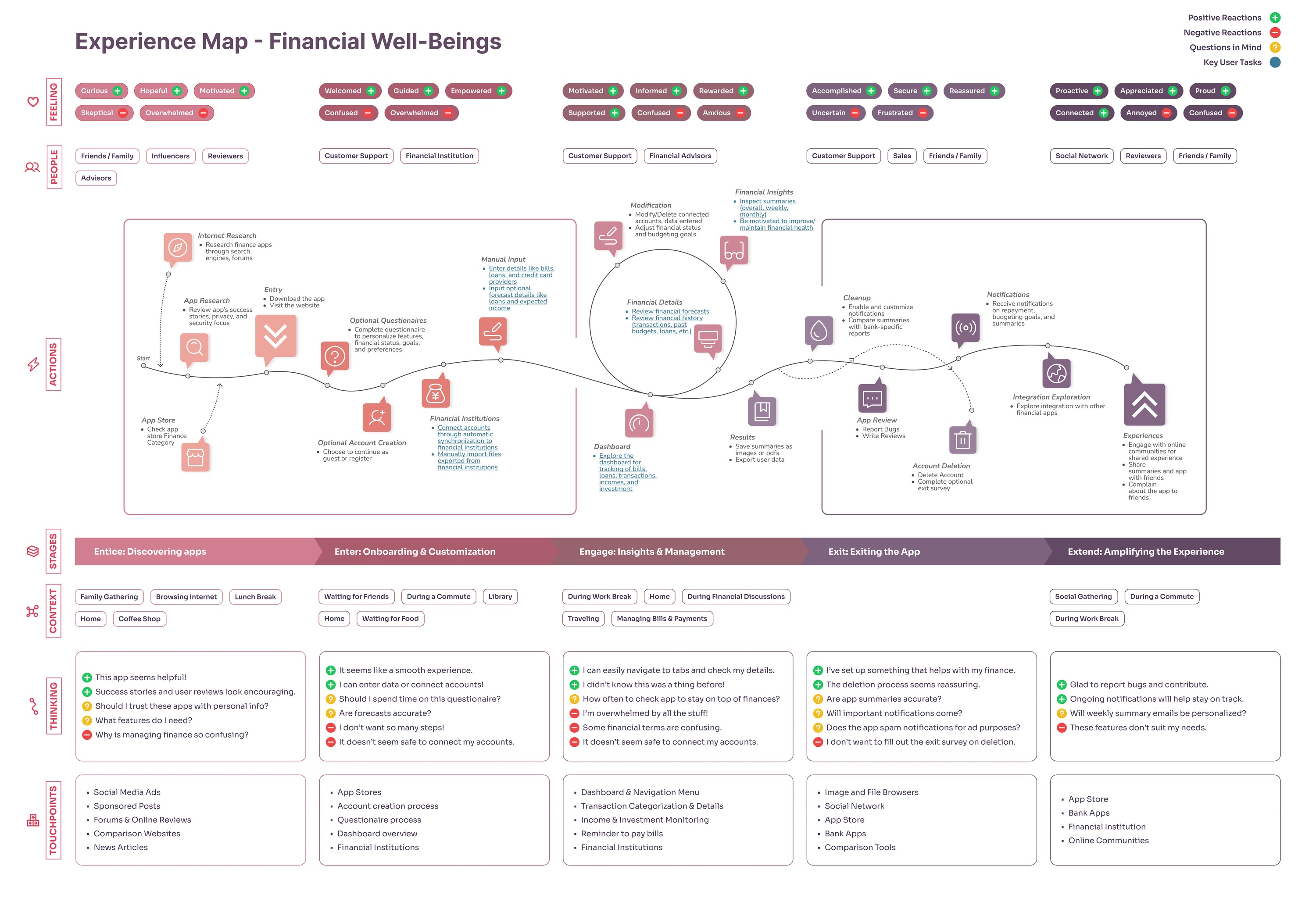

Experience Map,

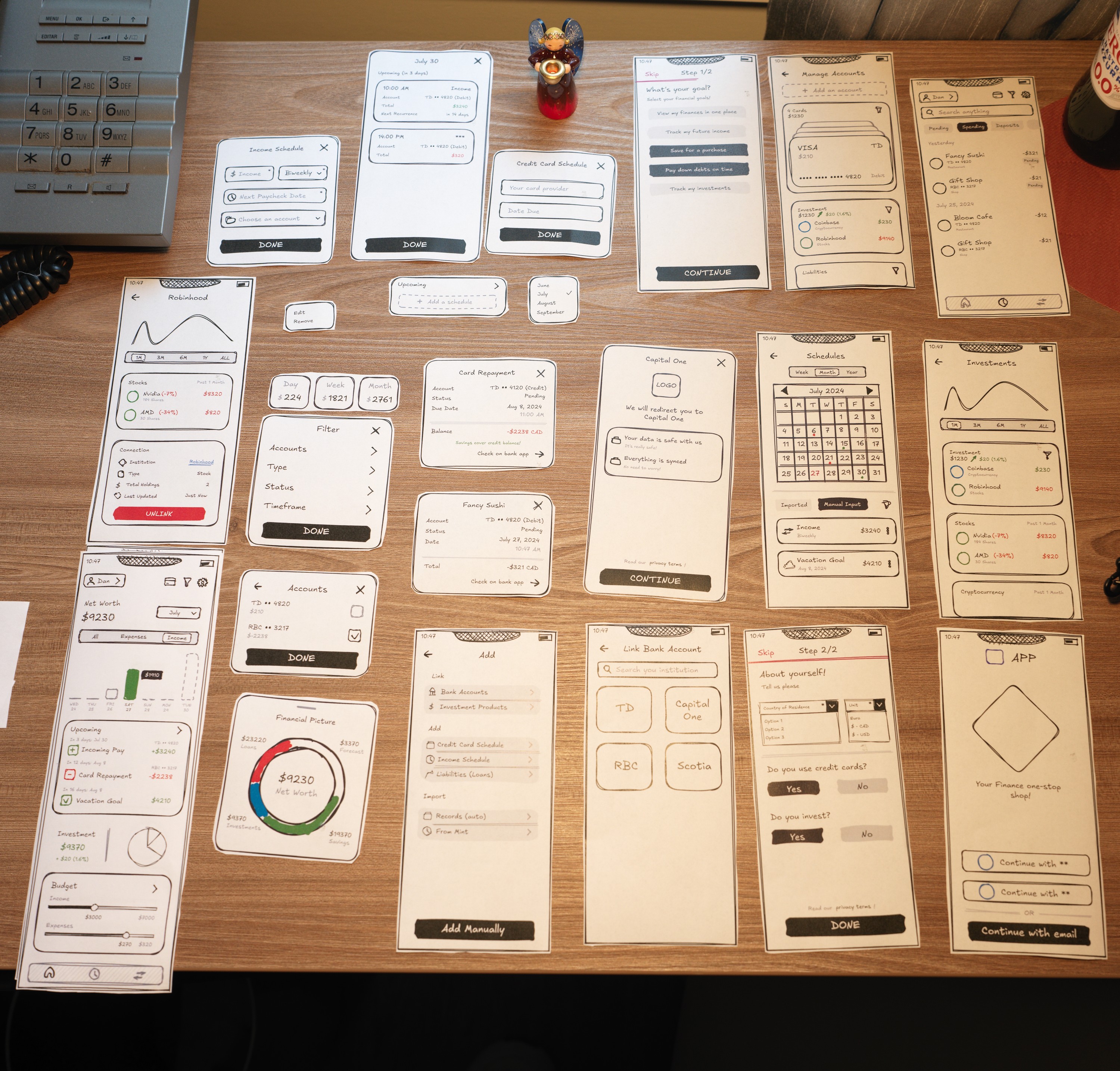

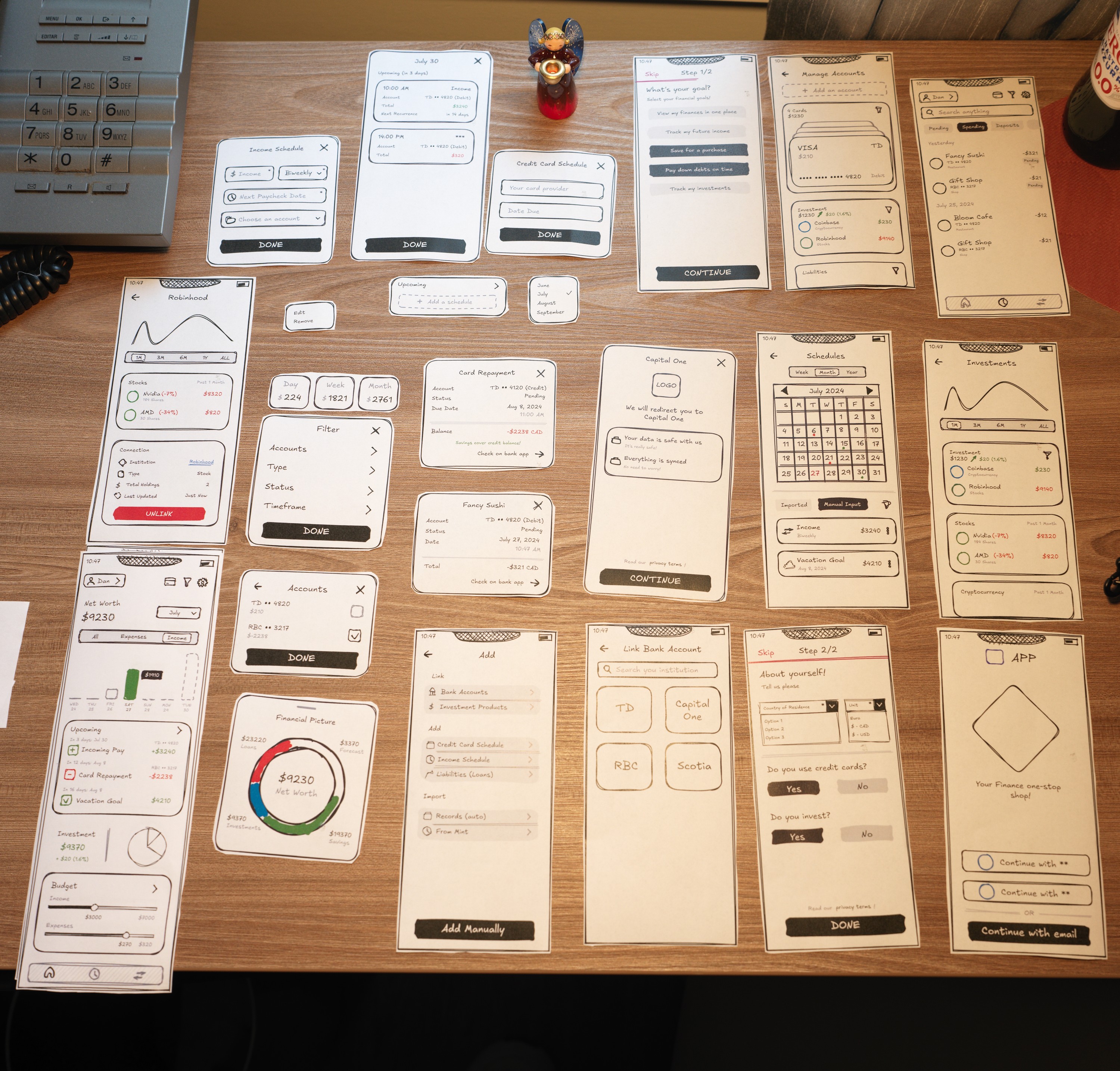

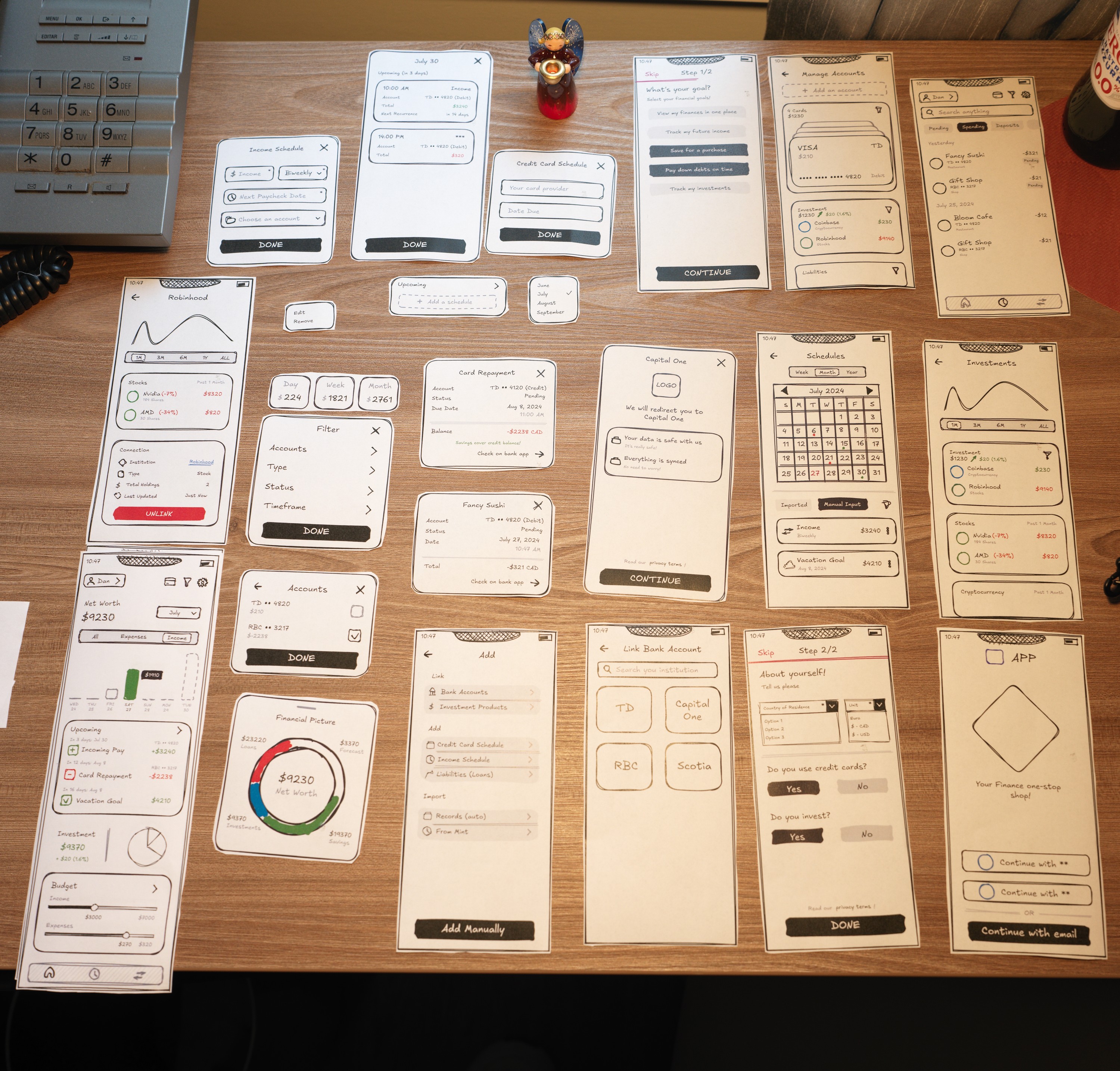

Prototyping,

Usability Testing,

React.js